How to do Accounting for Landscaping Business Evans Sternau CPA

The reason is that materials/equipment are marked up before they are sold to the customer. You’re still at risk of missed payments or other curveballs in your invoice payments. Still, the accrual method provides a broader look at a company’s current financial position by forecasting where it should be once payments are made. This means that once a customer is billed or your business receives supply charges, you immediately track these transactions.

Third Party Applications – QuickBooks Online has the ability to sync with your applications, which can save you time. You may have a landscape management software where you create estimates, invoice, receive payments, routing, and many other functions. Many of these landscape management software applications sync with your accounting system, making it easy to copy over invoices and payments. There are also time tracking software’s that integrate to your accounting software, making job costing easier. Record all revenue and expenses consistently and accurately to avoid confusion and ensure that you can easily produce accurate financial statements. You can use accounting software to create invoices, pay bills, track expenses, and monitor cash flow.

- As your business grows, you will need to decide if you can afford to spend time indoors entering numbers when you could be outside focusing on lawn care.

- When it comes to monthly tasks, you should double-check your expense record in a process called reconciliation to ensure nothing was missed.

- If you’re currently using the cash method and want to make a change to accrued, you should know a few things.

- In this section, we break down the basics to help you decide what is best for your business and your unique situation.

- In conclusion, accounting is an essential part of any landscaping business.

The job scheduling features will help you track what jobs are scheduled, pending, what resources are available. Using a tool for scheduling, dispatching, tracking, and routing can really make work life a dream. Make it easy for your clients to pay you quickly and easily—straight from your invoice.

Lawn Care Bookkeeper

Not having a business forecast limits your ability to adapt and fuel expansion, deflating growth or even slowing your business down. It might not seem significant, but the timing difference can seriously affect your financial statements. The safety of your private data is our top priority, that’s why it’s protected by 256-bit SSL encryption—the gold standard in Internet security. The FreshBooks billing system is cloud-based and uses industry-leading secure servers. With FreshBooks there are no contracts, and you’re not locked into an agreement. With an array of solutions in the market, choosing the right one for your specific needs could be a challenging task.

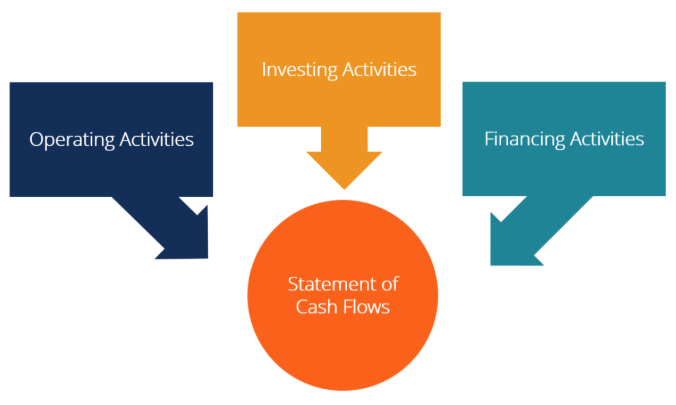

With bookkeeping software, you can generate reports on profit and loss, accounts receivables, cash flow, and more. The best landscape accounting software automates sales tax calculations, ensuring accuracy and compliance with local tax laws. This feature significantly reduces the manual work involved in tax calculations.

Let’s assume a $500/month loan payment is made up of $100 interest and $400 principle. Uncle Sam only allows the $100 interest to show up as an expense in your P/L statement. However, the full $500 flowed out of your company and needs to be considered when setting proper hourly rates. An accrual system is powerful for fueling fast-paced, high-growth businesses but does come with additional challenges.

Understanding Bookkeeping for Landscaping Business

They will help you keep track of your weekly and monthly bookkeeping needs. They will also help you identify trends through your financial statements. A CPA will give you the best information to find solutions to your financial problems before they become problems.

His last twelve-month P/L statement showed a net profit of $109,000, which they had to pay taxes on. However, when we subtracted out the principle portion of his loan payments and the difference in depreciation and equipment replacement costs, his “real” net profit was really a loss of $81,000. As a landscaper, if bookkeeping is not your strong suit, hiring a bookkeeper can help you to manage your finances effectively. A bookkeeper can help you set up your bookkeeping system, maintain your financial records, and ensure compliance with tax laws and reporting requirements. Landscapers must avoid common bookkeeping mistakes such as failing to keep accurate records, mixing personal and business expenses, and not reconciling bank statements regularly.

Bookkeeping and Payroll For Landscaping Business

Do you have an existing bookkeeping system that has been making errors or takes more time than you’d like? In this case, hiring Better Bookkeepers for a one-time review is your solution. We can perform an exhaustive review of your books and documentation procedures, identify problems, and propose lasting solutions. Furthermore, we can design a new system that’s specialized to the unique needs and priorities of your business.

Bookkeeping for LandscapersAs a landscaper, keeping track of your finances is essential for running a profitable business. Bookkeeping is the process of recording, classifying, and organizing financial transactions. It helps landscapers to track their income and expenses, manage their cash flow, and make informed financial decisions.

In some cases, this can enable businesses to be more strategic with their plans because they have a complete understanding of incoming and outgoing cash flow. In other cases, it can be risky and lead decision-makers to prepare for wider Bookkeeping for landscaping business margins than currently available. Just because you know you have contracts coming to an end doesn’t mean you suddenly have an increase in revenue in a cash-based accounting system—you have yet to see the payment for those jobs.

Bank Connections: For easy reconciliation

This is one of the most important questions you can ask when you’re handling accounting for landscapers. The IRS says that businesses can claim all ordinary and necessary expenses that they incur for their business. If you don’t track all your expenses, you will face a higher tax liability than you should. However, using bookkeeping software is a better alternative to help keeps things separate and organized.

Bookkeeping for Landscaping and lawn care business near you

Linda Rost started Better Bookkeepers in 1999, and since then the team has worked for over two decades. In this time, we’ve developed bookkeeping solutions for countless unique, small businesses and honed razor-sharp attention to detail. While QuickBooks can’t replace human bookkeeping services, it empowers you to maintain your books more accurately with less effort.

Bookkeeping—or managing your financial accounts—may look different depending on the scale of your operation, but it’s an aspect of the business that shouldn’t be neglected. But as the business grows, the complexity of your finances will also change. You may add employees, invest in more expensive equipment, opt to be taxed as an S-corp, or encounter other complexities. Ultimately, you may need professional help for your accounting and other financial needs.

ZarMoney’s Advance Inventory features ensure that landscaping companies can track their resources in real-time. Want to experience software that helps landscapers grow at three times the industry rate? Schedule a landscaping business management software demonstration with Aspire and see how you can take your profits to the next level.

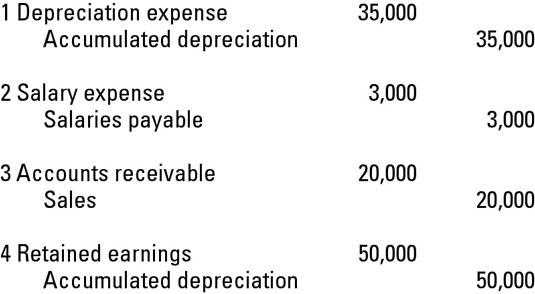

Setting up green industry chart of accounts is essential because it will enable you to compare your business financials to other green industry businesses confidently (comparing apples to apples). It also ensures that you properly record items into the correct account types such as assets, liabilities, equity, income, cost of sales, and overhead expenses. It increases efficiency to have a correct and standardized chart of accounts, because it takes the guess work out of the equation.